¿Está buscando alternativas a PayPal para que los autónomos puedan cobrar pagos en WordPress?

PayPal es una de las plataformas más sencillas para cobrar pagos en su sitio web. Sin embargo, no está disponible en todos los países y puede que no todos tus clientes quieran utilizarla.

En este artículo, compartiremos algunas de las mejores alternativas de PayPal para que los autónomos puedan cobrar pagos en WordPress.

Por qué buscar alternativas a PayPal para aceptar pagos en Internet

PayPal ha hecho que las transacciones en Internet sean rápidas y sin complicaciones. Permite a los propietarios de sitios WordPress ganar dinero en Internet vendiendo productos y servicios.

Sin embargo, existen ciertos problemas con PayPal que llevan a muchos clientes potenciales a buscar alternativas a PayPal.

Por ejemplo, hay varios países en desarrollo donde PayPal no funciona. Y las herramientas de los autónomos más populares se pueden comprar con PayPal, por lo que supone un obstáculo para los usuarios.

Además, los gastos de transacción de PayPal también son más elevados y pueden aumentar considerablemente con el tiempo.

Quizá la razón principal por la que la gente busca alternativas a PayPal es su comportamiento incierto.

Además, muchas cuentas PayPal han sido bloqueadas o suspendidas por problemas / conflictos / incidencias sin importancia, lo que ha causado grandes pérdidas a numerosos usuarios de PayPal.

Ahora, para ayudarle, hemos encontrado los mejores servicios de pago que puede utilizar como alternativas a PayPal en su sitio de WordPress.

1. Stripe

Stripe se ha convertido rápidamente en la alternativa más popular a PayPal y en una de las pasarelas de pago más populares. Por desgracia, solo está disponible en unos pocos países.

Lo mejor acerca de usar Stripe son las cuotas más bajas, la facilidad de uso y la perfecta integración en plataformas populares de comercio electrónico de WordPress como WooCommerce y Shopify.

Si no quieres establecer una tienda online completa, entonces puedes crear un simple formulario con WPForms para cobrar los pagos vía Stripe de tus clientes.

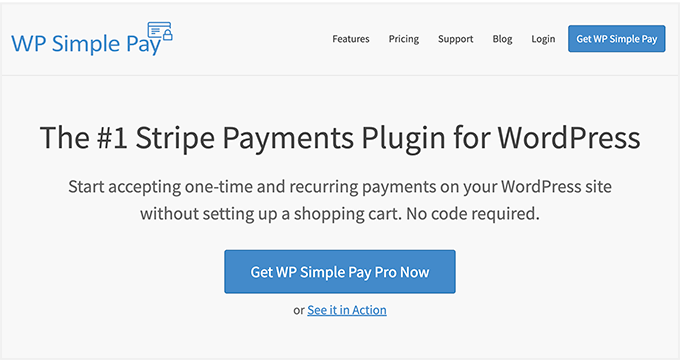

Y si quieres una solución aún más sencilla, entonces deberías instalar el plugin WP Simple Pay en tu sitio WordPress.

WP Simple Pay es el plugin de pagos Stripe para WordPress más popular. Le permite recoger una sola vez y los pagos en línea periódicos de sus usuarios sin necesidad de añadir un carrito de compras o páginas de productos dedicados.

Además, WP Simple Pay viene con plantillas de formularios de pago ya preparadas y un maquetador de formularios personalizado para personalizar sus formularios de pago.

Esto lo hace todo más fácil para los principiantes que quieran aceptar pagos con Stripe.

Las cuotas de Stripe varían en función del país en el que te encuentres. Para Estados Unidos, tienen una cuota corregida del 2,9% + 30¢ por cualquier cargo realizado correctamente con tarjeta de crédito.

2. Sabio

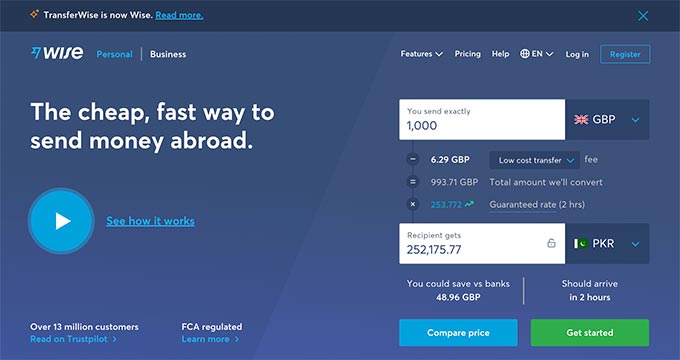

Wise (anteriormente conocido como Transferwise) permite a sus clientes pagarle directamente en su moneda local. El pago se cargará a tus clientes y se enviará a tu cuenta bancaria como una transferencia regional.

Está disponible en muchos países y divisas. Las cuotas varían en función de la ubicación del remitente y del destinatario.

Sin embargo, hemos comprobado que suele ser mucho más bajo que otros servicios de pago o que una transferencia bancaria directa. También utilizan la misma tasa / tarifa de cambio que se ve en Google o XE, lo que también le ahorra dinero adicional en el cambio de divisas.

Un inconveniente es que Wise no permite enviar pagos a empresas en algunos países.

Por lo tanto, le recomendamos que se asegure de marcar / comprobar la página del país antes de solicitar a sus clientes que le envíen dinero para conocer el precio y el estado del pago de la empresa.

3. Bitcoin

Las criptomonedas están de moda hoy en día. Bitcoin es una de las primeras y más conocidas criptodivisas del mundo.

También permite a los usuarios enviar y recibir dinero a través de las fronteras sin necesidad de intermediarios, como bancos u operadores de transferencias, que se llevan una parte de la transacción.

Si su cliente está familiarizado con Bitcoin, podrá transferir dinero fácilmente a su monedero / billetera / cartera virtual de Bitcoin.

A continuación, puede convertir esta cantidad en moneda local a través de un intercambio de Bitcoin, utilizar la cantidad en línea o transferirla a cualquier otro servicio de pago.

Coinbase, una plataforma de intercambio de bitcoins, permite a las empresas aceptar pagos en bitcoins. Ya la utilizan empresas punteras como Expedia, Dell, Intuit y la Fundación Wikimedia, entre otras.

4. Payoneer

Payoneer es un nombre fiable en el sector de los pagos en línea. Está disponible en muchos países de todo el mundo.

Actualmente no hay integraciones disponibles para conectarlo directamente a su comercio electrónico o sitio web de membresía. Sin embargo, puede solicitar a los clientes que envíen los pagos a través de Payoneer.

Payoneer también hace que sea muy conveniente para retirar los pagos en su cuenta bancaria local o utilizar Payoneer tarjeta de débito de marca para retirar los pagos de los cajeros automáticos en cualquier parte del mundo.

El inconveniente es que sus cuotas son más altas en comparación con Stripe o PayPal, pero más bajas que las de otros proveedores de servicios de pago.

Por aceptar pagos con tarjeta de crédito directamente de los clientes, se le cobrará el 3% del importe de la transacción. Además, se le cobrará 1,50 $ por una transferencia bancaria local en la misma divisa. Si retira el importe en una cuenta en otra divisa, pagará un 2% adicional del importe de la transacción.

5. QuickBooks

QuickBooks es uno de los mejores programas de contabilidad para autónomos y profesionales. Te permite enviar fácilmente facturas a tus clientes y aceptar pagos directamente en tu cuenta bancaria.

Sus clientes pueden hacer clic en el botón de pago en cualquier momento y realizar pagos utilizando sus tarjetas de crédito.

QuickBooks es un programa de contabilidad, por lo que puede conectarlo a sus tarjetas de crédito, cuenta bancaria y PayPal para capturar todas sus transacciones.

QuickBooks es una solución de pago por uso. Las cuotas por pago con factura son del 2,9% + 25¢ en cada transacción. Si factura más de 7.500 $ al mes, puede ponerse en contacto con ellos para obtener una tasa / tarifa con descuento.

6. Verifone

Verifone anteriormente conocida como 2Checkout es una de las pasarelas de pago más conocidas y una buena alternativa a PayPal. Todos los plugins populares de comercio electrónico para WordPress tienen extensiones para integrar Verifone como pasarela de pago.

También puedes añadirlo a tu tienda online y empezar a vender productos a países donde Stripe o PayPal no son compatibles.

Verifone ofrece diferentes métodos de retirada de pagos, e incluso puede integrar su tarjeta de débito Payoneer para retirar pagos.

Otras características destacables son los pagos periódicos, la experiencia de finalizar compra / pago con alojamiento, las múltiples divisas y el soporte de idiomas.

Las tarifas de Verifone varían en función del país en el que se encuentre. En Estados Unidos, se le cobrará el 2,9% del importe de la transacción + 30¢ en cada transacción.

7. Google Wallet

Google Wallet es otra excelente opción para sustituir a PayPal en tus pagos. Actualmente solo está disponible en Estados Unidos y el Reino Unido, y no puedes enviar pagos desde Estados Unidos al Reino Unido.

No tiene una integración de fábrica disponible para ninguna plataforma de comercio electrónico de WordPress.

Al igual que muchas otras herramientas y servicios de Google, no cobra ninguna cuota por enviar o recibir dinero.

Esto lo convierte en una gran opción para los autónomos que quieran solicitar pagos de clientes a través de Google Wallet.

Esperamos que este artículo te haya ayudado a encontrar las mejores alternativas a PayPal para cobrar pagos en WordPress. Puede que también quieras ver nuestra guía definitiva de seguridad de WordPress paso a paso para principiantes.

If you liked this article, then please subscribe to our YouTube Channel for WordPress video tutorials. You can also find us on Twitter and Facebook.

Syed Balkhi says

Hey WPBeginner readers,

Did you know you can win exciting prizes by commenting on WPBeginner?

Every month, our top blog commenters will win HUGE rewards, including premium WordPress plugin licenses and cash prizes.

You can get more details about the contest from here.

Start sharing your thoughts below to stand a chance to win!

ahmed says

Hi there,

Does Quickbooks work with any country or are anywere some restrictions ?

Thank you

WPBeginner Support says

Unless we hear otherwise it does not have a country limitation but you would want to check with Quickbooks for their most up to date information on any limitations

Administrador

Ramesh Gupta says

It is such a great blog with wonderful information.

WPBeginner Support says

Thank you

Administrador

alex says

Is there any plugin for transferwise like paypal,stripe etc, i mean how to provide an easy way for customer to pay for products in online store with transferwise.

evan says

It seems transferwise is removed as plugin and no longer available!!

Rahul Rawat says

It is such a great blog with wonderful information….keep it up!!!!!!

Kingsley says

stripe, payza, google wallet are useless for developing countries just like paypal

Jay says

Does anyone have payoneer plugin for WordPress?

Giorgos says

payoneere dont use payment gateway via plugin. you have to send payment notification via email to your customer, i use it as well. once i spoke with them and asked them about a plugin but they told me that is not in there plans . but maybe in the future.

Bilguun says

Can i use these alternatives to ebay and shopify? Sorry i want it to clarify.

Bell says

SEO has never really had a proper home, because its technical it is best suited for people who have learnt

the industry and have experience, this can be quite rare with SEO’ers though

Posted this to Twitter, very useful

Subhrajit says

The prob i face with payoneer is they don’t provide the pay now button in invoice for Indians

Daniel says

This might be a bit way around, but I am considering an option to use WooCommerce plugin for wordpress. And then to choose between other payment processing providers, like Stripe or cardinity. Do you think it could work for collecting payments in WordPress or straight forward plugin charges less for the payments?

jay says

hi..what mode of online payment is better for me?as iam gonna do online job for the first time and pls intimate me which one is most trusted and charges less.iam frm Mumbai..Thx

leona zoya says

After two years of using Payoneer, and having regular, decent transactions, Payoneer blocked my account two months ago, without any explanation or given reason. Every attempt I’ve made to figure out what has happened, on live chat, ended unsuccessfully, with an explanation that they will contact me by mail. In 2 months I didn’t get any e-mails from them, and I’ve contacted them on live chat about 10 times. The last time I’ve contacted them, they disconnected me before I even got a chance to ask them what is happening. I still have 200$ on my account, which I cannot withdraw. It could have even been more.

I want to use this opportunity to warn all the people in the world to stay away from Payoneer, and all of those using it currently, to stop, because they can, apparently, block your card without any reason, or explanation, just like they did to me!!!

Watt says

Sounds like what Paypal did to me.

The more they grow, the less they care about their customers.

Eventually I’ll just have to give my account number to my customers so they can send me the money directly

James says

Exactly what PayPal did to me! I would recommend all serious online merchants to stay away from Free Payment gateways such as Paypal and Payoneer

Andrew Essiet says

Payoneer only blocks an Account where there is suspicious transaction. You could go to your page an unblock it. They are not like PayPal at any level. They only do what they are doing to protect your Account from being tampered with illegally.

Giorgos says

hello

i am using payoneere a long time. never had a problem. but, the last view times when i send email notification for payment, they always asking me if this a business or private payment. maybe they want to make clear to registry business into business account. just a thought from me!

Arafat says

Good read, thanks. Paypal is a great payment method for freelancers. For many reasons you may need a different payment option other than PayPal. Payoneer can be a good alternative to PayPal to receive funds from freelancing marketplaces. I enjoyed Moneybookers in 2011, but (now) Skrill has changed their policy so people from our country are facing difficulty with this. If I were to choose top 3 payment methods for freelancers, I would select PayPal, Payoneer and Skrill. You may read my post about it:

Laura Key says

Nice information…But still paypal rules the world of Freelancers

Gustavo says

Hello. I have a payoneer account wi a virtual us bank account. I wonder if I can use stripe with it. Since I’m located in Argentina I wonder if my stripe account will allow the transfers. Thanks for the help.

Julian says

I have been using Selz until now that they stopped accepting credit cards for stores outside US and forced me to use PayPal ($4.99/mo). It would be fine to pay that to keep the site up, but I didn’t like the way they are doing businesses in XXI (changing the rules as it is).

Moshiur Rahman says

For getting my freelancer payment I always love Payoneer.

Mustafa Bépari says

Can you receive payments from individual clients? For example, if a client wanted to deposit cash into your virtual bank account from the US, would you receive it on your Payoneer card?

Bryan says

You have to receive payments from Payoneer associates first then you can get payments from individuals.

Josh says

For Stripe, there is a nice hosted little payment form you can use. It connect to your Stripe account and you can send a payment link to your clients.

Turqoisse says

Thanks for a great article! It is quite hard to find strong alternatives to PayPal. I’ve been looking around for some time already, and found really contraversial opinions. But I guess this is the problem when we talk about money I’ve been using Google Wallet for some time for my personal online payments, But when choosing the online payment tool for my small family business I did not want to jump from one big corporation to another. My advice would be to go into details of specific region and market you are selling, and get to know your customer. I am selling hand made jewelry to European markets mostly and what I’ve found is that my clients do not trust PayPal in general. i received many request of using the alternative payments which are popular there, like Skrill, Paysera or Payza. Apparently they are really popular and appreciated for the small benefits they provide. So, I would say there is no general rule, everybody is different and every specific business needs different online payment solutions.

I’ve been using Google Wallet for some time for my personal online payments, But when choosing the online payment tool for my small family business I did not want to jump from one big corporation to another. My advice would be to go into details of specific region and market you are selling, and get to know your customer. I am selling hand made jewelry to European markets mostly and what I’ve found is that my clients do not trust PayPal in general. i received many request of using the alternative payments which are popular there, like Skrill, Paysera or Payza. Apparently they are really popular and appreciated for the small benefits they provide. So, I would say there is no general rule, everybody is different and every specific business needs different online payment solutions.

Snorre says

What would be the best payment gateway that accept debit-/ credit-cards for sites on servers in Europe. Selling worldwide online service. Just one product, one price.

Selva Prabhakaran says

Is Selz available in India ?

mimi says

Selz requires a PayPal address unless you live in Australia.

Erika Madden says

They now have direct deposit into your bank account.

Temi Grand says

Does selz have deposit link in Africa? Particularly Nigeria?

Ifham khan says

Using Gumroad from last one year and I must say, its the best

Val says

On the contrary, I had a terrible experience with Gumroad. The service is only useful if you sell digital products (Freelancers that provide online services are not allowed), you don’t mind vague customer support or sketchy TOS, and you don’t mind waiting 14 days to receive payment. For those reasons, I definitely would NOT recommend Gumroad.

Anirban Pathak says

Great Post. For my account with them, they only allow payments from advertising networks and established companies. Also their fees are beyond high, they are extortionate.

Maketta says

Hello Jawad,

That was a very comprehensive list. There is always nice to have more than one option. Thanks for sharing this with us!

Enstine Muki says

Is Payoneer a Payment Processor? Can you integrate that on your website and collect payments from clients?

SAM says

no you cant, but this company promotes themselves as they offer that service, and websites like this, (sorry have to say that) just copy paste what payoneer says without further investigation on this.

payoneer is not a payment processor you can’t integrate on your website, you can’t receive money for sale products or services. you only can receive direct load from certain countries, to only certain countries, to only certain list of allowed products /services (good luck trying to find that list), and if you manage at final to do all that, they can do with your money whatever they like, you have no rights to claim. staw away from payoneer , really. search google their user forum

Naveen says

PayPal is one of the top mediator for sending and receiving money worldwide and their commissions and conversion rate is pretty bad since this is only the option to receive money for some countries due to some restrictions.

The other ways Google wallet, payoneer seems good alternative.

Thanks.

shubham says

I don’t like paypal beacuse it needs PAN card to register with them(maybe for indians) :/

Payza is also a good alternative.

ravi says

hi there,,,

i have a wordpress website…

and in this site, i need to setup payment with payza for membership..

do you have any idea how can i do that..?

Anurag Dhatrak says

Hey btw ……Google Wallet cant be used in India.. if it was possible it would be awesome

Jamie Bull says

Don’t forget BitPay.

WPBeginner Support says

No we didn’t here is how to add a Bitcoin button in WordPress using BitPay

Administrador

Dave Clements says

+500 for Stripe!!!

jeremy says

Payoneer sucks if you are not in the US. They are extremely strict about how you add funds and the idea that ‘anyone’ can credit your account is plain wrong.

For my account with them, they only allow payments from advertising networks and established companies. Also their fees are beyond high, they are extortionate.

I cannot say how bad they are (outside the US)… maybe they are better in the US, but i doubt it.

ZaFr says

Stunning Article about Payment Gateway…. This is the best post i came about the Alternative of payment for wordpress… I go with Stripe & Selz best for my website beside Paypal

Also please Do Correct the Spell on Payoneer’s “MaterCard”.

Thanks,

ZaFr

TheBigK says

All are valid services, but I would like to find one that is FDIC insured. I was told PayPal was FDIC insured and then found out the answer is still questionable.

Alberto Nunes says

Hi!

One that I’m starting to use right now is Gumroad: https://gumroad.com/

It is teally great!

Khaleesi says

It is known.

Sü says

Do you still need a SSL certificate to use google as a payment gateway?

Hasin Hayder says

Don’t forget to checkout Gumroad Really nice one

Really nice one

David Bay says

This is a good and concise summary, I am setting up an eCommerce site at http://www.pressentz,com and have chosen to run with both paypal and Stripe and was thinking of adding Amazon checkout.

Aaron says

You should fix your Wordfence configuration, unless you’re purposefully blocking all UK traffic?